site

The Arkansas State Capitol Police Department is a law enforcement agency that has the primary responsibility for the protection and security of the State Capitol grounds, the legislative body, state employees working within the Capitol complex area, and visitors to the State Capitol.

The Arkansas State Capitol Police Department was created in 1874 and has evolved over the years. Currently, the Department has thirty sworn personnel and three professional staff.

Anyone in need of police service should contact our dispatch office at (501) 682-5173.

Voices & Votes: Democracy in America

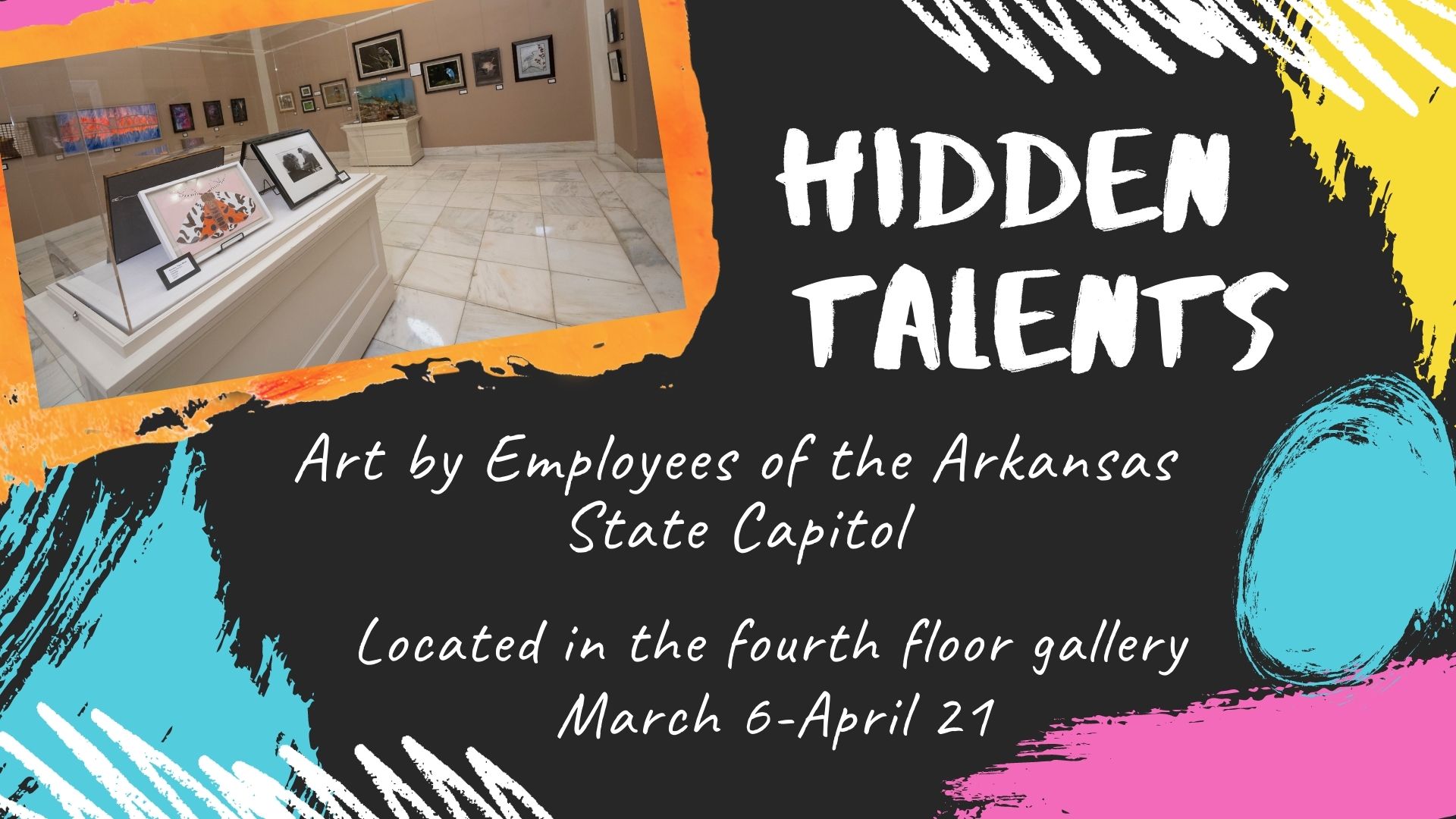

Hidden Talents: Art by Employees of the Arkansas State Capitol

Special Delivery: Postal History in Arkansas

Please note that the Arkansas Secretary of State’s Office maintains curatorial oversight for all projects accepted.

Click here to learn more about exhibit layout and space.

Note: We are currently revising this application form. Please check back soon.

Fill out and complete this form to request an Arkansas Traveler Certificate. If you have questions or concerns, reach out to Lyndajo Jones-Watson at lyndajo.jones@sos.arkansas.gov or by phone at 501-682-3013.

Form MUST BE submitted at least 5 business days prior to presentation.

2022 LEGO Exhibit

Statements of Heritage

Framing a More Perfect Union

The River Remains: 50 Years on the Buffalo National River

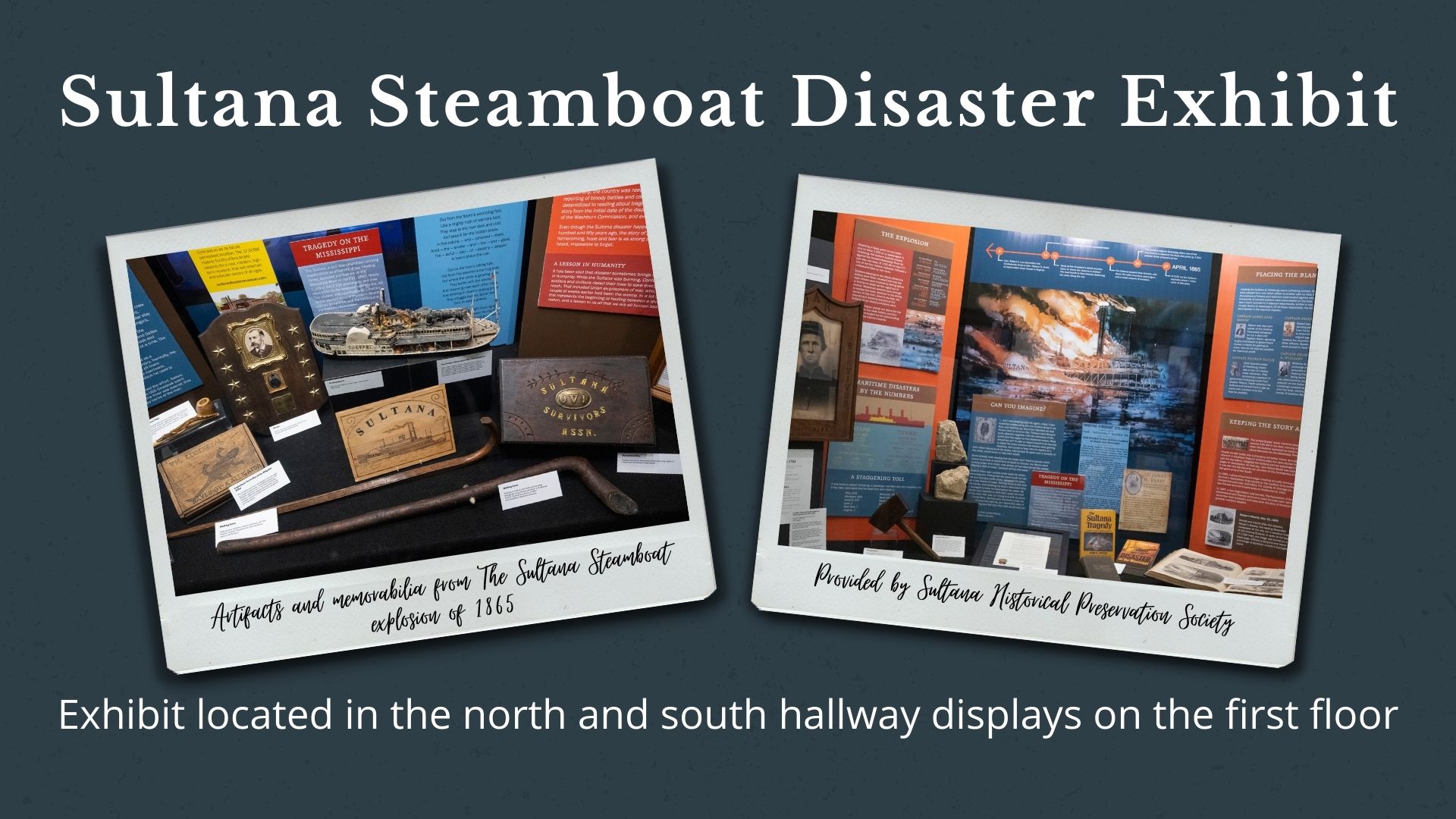

Sultana Steamboat Disaster Exhibit

100 Years of National Parks/Hot Springs Spas

The Natural State Cafe is a casual café serving breakfast and lunch. Located in the Lower Level of the Arkansas State Capitol, it is open Monday-Friday from 7:00 a.m. - 1:30 p.m.

Visit us on Facebook, or subscribe to our newsletter to receive our daily lunch specials.

Commercial Services (UCC) FAQ

Frequent Asked Questions

What is a ticket tracking system?

A ticket tracking system is a method for reporting problems electronically. When you experience an error, you can report the incident and receive a ticket number. Using the ticket number you can track the progress of your problem until it is resolved by technical support. You can use the ticket tracking system to correspond with technical support, even send and receive files through the system.

Why use this system? Why not just call technical support?

By submitting an error report to the system, you can easily track and document your problem, and the responses from technical support. Since technical support is alerted each time a report is submitted, you may get a faster response than calling on the phone.

What are the transaction fees associated with the UCC Online Filing System?

New Filing $16.00; Termination (of Filings dated earlier than 7/28/1995) $6.00; Termination (of Filings dated on or after 7/28/1995) No Charge; Continuation $6.00; Search (with results) $6.00 Search (no results) $6.00

Why should I file electronically?

Savings (No monthly fees, No hidden fees, No Postage, No copy charge) Convenience (No paper forms to fill out, no mail delays, speed) Speed (Instant search results, position granted immediately)

Is electronic filing legal?

Yes, Revised Article 9 has passed in Arkansas.

What about signatures? Is it legal to file a UCC electronically without wet signatures?

YES! According to the Uniform Electronic Transactions Act of 2001, the State of Arkansas allows online UCC filings. Please see the Uniform Electronic Transactions Act for more information.

Do I need an Internet connection?

YES! You should have a local ISP (Internet Service Provider). Your performance speed will be affected by the speed of your connection.

How do I get connected to an Internet Service Provider?

There are numerous national and/or local Internet Service Providers. Your ISP may be a local cable company, phone company, or other communications provider. Typical ISP charges range from $10 to $40 per month for service including email and other services. Once you connect to an ISP, there are no additional communication costs associated with UCC electronic filing and searching!

What is a Submitter Account, why do I need it, and how do I get one?

The Information Network of Arkansas requires all electronic UCC filers to have a Submitter Account in order to use the Online Filing System. To apply for an online account type in http://www.sos.arkansas.gov/corp_ucc_commercial.html in the address line of your web browser. Then click on “UCC Online Search & Filing “, then “New User? Register Here” and complete forms. The annual subscription fee is $150.00.

Are fixture filings affected by the change in the law?

This change does not affect the filing of a mortgage on the related real property if the collateral is “as-extracted collateral or timber to be cut” or if the financing statement is filed as “a fixture filing and the collateral is goods that are or are to become fixtures”.

How do I continue a document that is not recorded with the Secretary of State?

Financing Statements that need to be continued must be submitted on a UCC-3 and be accompanied by certified copies of the initial financing statement (which includes all additional subsequent filings related to the initial file.)

Can financing statements be continued or amended online?

Filers that wish to file continuations or amendments online should check with the SOS office to determine if their imaging software is adequate for the required document upload. The online filing system has been re-designed to help users through the process with an easy to follow step by step program. If submitting by mail, then simply send all documentation along with the UCC-3 to the Arkansas Secretary of State’s BCS division.

What are the filing fees?

UCC 1(termination included) - $16.00 UCC 3- $6.00 Searches - $6.00 - Please note on filings transferred from the county clerk’s office the SOS will not charge the additional page fee on those copies. However the circuit clerk may charge for the certified copies obtained from that office.

What filing numbers will I use to find documents with the Secretary of State’s Office?

Once the UCC filing is on file with the Secretary of State’s Office the file will be given a new filing number. From this point forward all references with this office will be conducted with the new filing number. All county filing numbers will not be searchable in the SOS centralized database.

Where are farm stored commodity loans financed by the Commodity Credit Corporation of the USDA to be filed?

These filings will remain with the circuit clerk until December 31, 2012. Starting January 1, 2013 these filings will then transition to the Secretary of State’s Office.

When can a filer continue or amend a UCC financing statement and transfer it to the Secretary of State’s office?

Anytime after December 31, 2009, a file may be continued or amended at the Secretary of States office. However continuations will be rejected if they do not fall within the six (6) month continuation window.

When I continue a financing statement with the SOS, what will the new lapse date be?

When the financing statement is continued with the SOS, the initial filing date will be manually changed to reflect the original filing date. Therefore the new lapse date will be the same as if it were to have been continued in the circuit clerk’s office.

Arkansas Election Video 1 - How to Register to Vote

Arkansas Election Video 2 - Voting on Election Day

Arkansas Election Video 3.1 - Absentee Voting

Arkansas Election Video 3.2 - UOCAVA Voting

Arkansas Election Video 4 - Early Voting

Arkansas Election Video 5 - Election Poll Worker

Arkansas Election Video 6 - Voter Security

Teacher Resources

Let us bring the State Capitol to your Classroom! We offer virtual tours, classroom presentations, lesson plans, free resources for your classroom, and so much more! Follow the links below or contact our Education Team for more information.

|

|

|

| State Capitol Tours | Young Voter Workshop | Teacher Workshop |

|

|

|

| Educational Downloads | Classroom Presentations | Online Presentations |

Curriculum Maps & Lesson Plans (Kindergarten-4th)

Teacher Newsletter Signup

Nonprofit Corporation

Act 569 of 2007 requires nonprofit corporations to file an annual report with the Secretary of State’s office by August 1st of each year.

| Name of Official Document | Form # | Online $ | Paper $ | Online

Form |

PDF

Form |

| Annual Report for Nonprofit Corporations 2013 and before | N/A | N/A | N/A | ONLINE | |

| Annual Report for Nonprofit Corporations 2014 | N/A | N/A | N/A | ONLINE | |

| Annual Report for Nonprofit Corporations 2015 | N/A | N/A | N/A | ONLINE | |

| Annual Report for Nonprofit Corporations 2016 | N/A | N/A | N/A | ONLINE | |

| Annual Report for Nonprofit Corporations 2017 | N/A | N/A | N/A | ONLINE | |

| Annual Report for Nonprofit Corporations 2018 | N/A | N/A | N/A | ONLINE | |

| Annual Report for Nonprofit Corporations 2019 | N/A | N/A | N/A | ONLINE | |

| Annual Report for Nonprofit Corporations 2020 | N/A | N/A | N/A | ONLINE | |

| Annual Report for Nonprofit Corporations 2021 | N/A | N/A | N/A | ONLINE |

Capitol Construction

The Arkansas State Capitol was constructed between 1899 and 1915 on the site of the old state penitentiary using prison labor. Designed by architects George Mann and Cass Gilbert, the original construction cost was not to exceed $1 million. After two general contractors, four Capitol Commissions and six governors, the completed Capitol cost almost $2.3 million. In 1911, the General Assembly convened in the unfinished building for their first session at the new State Capitol.

The Arkansas State Capitol was constructed between 1899 and 1915 on the site of the old state penitentiary using prison labor. Designed by architects George Mann and Cass Gilbert, the original construction cost was not to exceed $1 million. After two general contractors, four Capitol Commissions and six governors, the completed Capitol cost almost $2.3 million. In 1911, the General Assembly convened in the unfinished building for their first session at the new State Capitol.

The neo-classical style of the building is a common example of monumental architecture of the early 20th century. The marble on the floors and walls came from Vermont, the columns from Colorado, and the grand staircases from Alabama. The exterior limestone was quarried near Batesville, Arkansas while a softer Indiana limestone was used for the dome. The Capitol contains 247,000 square feet. The distance from ground level to the top of the cupola is 213 feet. The cupola is covered in gold leaf.

Caring for the century-old State Capitol and its surrounding landscape is the focus of the Capitol Facilities Division of the Arkansas Secretary of State’s office. A variety of tradesmen maintain and preserve the Capitol itself, as well as the Capitol Hill Building and features around the campus. Housekeeping staff attend each of the offices located in the building while others nurture the 51 varieties of roses found in the Capitol’s test gardens.

Historical Capitol Construction Acts

1899 1901

1903 1909A

1909B 1913

Phone: 501-682-6244

Latest News:

Local beer producer donating hand sanitizer to polling sites around Arkansas. Click here for the story!

test

Some content here.

Educational Resources

Programs/Presentations

Videos

The Administrative Procedures Act, ACA 25-15-201 et. seq., requires state agencies, boards and commissions to file with the Secretary of State a copy of each rule adopted by the filing group. ACA 25-15-218 requires the Secretary of State to publish all state agency rule notices, emergency rules, adopted rules, proposed rules and financial impact statements on the Secretary of State website.

For questions about Administrative Rules email ArkansasRegister@sos.arkansas.gov.

- Search Arkansas Administrative Rules

- State Agency Public Meeting Calendar

- Agency Rule Filing Instructions

- Bulk Data Download

- Arkansas Register

- Register Proposed Sheet (To be filed with State Agency NOTICE rule filings)

- Register Transmittal Sheet (To be filed with State Agency FINAL rule filings)

Administrative Rules are filed by state agencies, boards, or commissions. Agency Rules “...interprets, or prescribes law or policy, or describes the organization, procedure, or practice of any agency…”. Administrative Rules do not concern the internal management of the agency, and are only filed by state agencies, boards or commissions. Administrative Rules are NOT filed by for-profit / non-profit businesses, property owners associations, or an entity not involved in state government.

For Election Officials:

Candidate Filing Notice:

Candidate Filing will be closed Tuesday, November 11, 2025 in observance of Veterans Day. Filing for partisan candidates will conclude at noon, Wednesday, November 12, and filing for nonpartisan judicial candidates will conclude at 3:00 p.m., Wednesday, November 12.

Candidate Filing Forms

- Candidate Information Form

- Candidate Information Form (Federal Candidates)

- Political Practices Pledge

NOTE: ALL FORMS MUST BE COMPLETED AND SIGNED IN DUPLICATE PRIOR TO SUBMISSION. TWO COPIES OF EACH MUST BE FILED WITH THE SECRETARY OF STATE.

General Candidate Info

- 2026 Candidate Search

- 2026 Election Calendar

- 2026 Running for Public Office Handbook

- Notice to Candidates: New Online Campaign Finance Disclosure System

- Financial Disclosure Portal

Links

Attention: All Candidates, County Political Party Committees, Exploratory Committees, Independent Expenditures, Political Action Committees and Political Parties will no longer file on the old website. Please use the link below to access the new filing system.

ATTENTION COUNTY FILERS: If you have not met the required threshold by December 31, 2025, please DO NOT register at this time, as our system automatically triggers reports upon registration.

Filers without a December 31 report should register closer to their report's due date. Those meeting the threshold for the December 31 report are encouraged to register in early to mid-November or early December.

Please consult the Arkansas Ethics Commission calendars to verify deadlines and thresholds.

- County Training Manual

- Online Financial Disclosure System

- County Campaign Contribution Reports Filed

Public Viewing:

Documents can be requested by calling our office at (501) 682-5070 or by emailing electionslibrary@sos.arkansas.gov.

Other Ethics Filing Information:

2022 Elections

2021 Elections

2020 Elections

- 2020 Special Primary Election for State House District 34

- 2020 Special Primary Runoff Election for State House District 34

- 2020 Special General Election for State House District 34

- 2020 Preferential Primary & Nonpartisan Judicial General Election

- 2020 Preferential Primary Runoff Election

- 2020 General Election and Nonpartisan Judicial Runoff

2019 Elections

- 2019 Special Primary Runoff for State Representative District 36

- 2019 Special Primary Election for State Representative District 36

- 2019 Special Primary Election for State House District 22

2018 Elections

- Special Primary Election - State Senate District 16, State Senate District 29, State House District 83

- Special Primary Runoff Election - State Senate District 16

- Preferential Primary & Nonpartisan General Election

- Preferential Primary Runoff Election

- Special General Election - State Senate District 8

- General Election & Nonpartisan Runoff Election

- Candidate Search

2016 Elections

- Preferential Primary & Nonpartisan General Election

- General Primary Runoff Election

- General Election & Nonpartisan Runoff Election

2015 Elections

- Senate District 16 Special General Election

- Senate District 16 Special Primary Runoff Election

- Senate District 16 Special Primary Election

2014 Elections

- General Election & Nonpartisan Runoff Election

- General Primary Runoff Election

- Preferential Primary Elections & Nonpartisan Election

- Senate District 21 General Election

2013 Elections

2012 Elections

- 2012 General Election Runoff

- 2012 General Election & Non Partisan Judicial Runoff Election

- 2012 General Primary (Runoff) Election

- 2012 Preferential Primary Elections & Non Partisan Judicial General Election

2011 Elections

- 2011 Special Highway Bond Election

- 2011 Special General Election for the Office of State Representative District 54

- 2011 Special General Primary (Runoff) Election for the Office of State Representative District 54

- 2011 Special Primary Election for the Office of State Representative District 54

- 2011 Special General Election for the Office of State Representative District 24

2010 Election Results

- 2010 General Election & Non Partisan Judicial Runoff Election

- 2010 Special General Election for the Office of State Representative District 21

- 2010 General Primary (Runoff) Election

- 2010 Preferential Primary Election & Non Partisan Judicial General Election

2009 Election Results

- Special General Election for the Office of Member of the Senate of the Arkansas General Assembly for District 4 - December 8, 2009

- Special Primary Election for the Office of Member of the Senate of the Arkansas General Assembly for District 4 - October 13, 2009

2008 Election Results

- 2008 General Election and Non Partisan Judicial Runoff Election and Special General Election for Prosecuting Attorney 9-W

- 2008 General Primary (Runoff) Election

- 2008 Preferential Primary Election & Non Partisan Judicial General Election

- 2008 Presidential Preferential Primary Election

2006 Election Results

- 2006 General Election and Non Partisan Judicial Runoff Election

- 2006 General Primary Runoff

- 2006 Preferential Primary and Non-Partisan Judicial General Election

- 2006 Special Election - State Senate District 14

- 2006 Election Results Publication - XLS

2005 Election Results

- 2005 Special General Election and Special General Election for the Office of the House of Representatives of the General Assembly for District 39

- Special Democratic Primary (Run off) Election for the Office of Member of the House of Representatives of the General Assembly for District 39 - November 1, 2005.

- Special Democratic Primary Election for the Office of Member of the House of Representatives of the General Assembly for District 39 Oct 11, 2005.

- Special Republican Primary Election for the Office of Member of the House of Representatives of the General Assembly for District 39 Oct 11, 2005.

- Proclamation for House District 39 Special Election - PDF

- Highway Bond - PDF

- Education Bond - PDF

2004 Election Results

- 2004 General Election and Non-Partisan Judicial Runoff

- 2004 General Primary (Runoff) Election

- 2004 Preferential Primary and Non-Partisan Judicial Election

- 2004 General Election and Non-Partisan Judicial Runoff - PDF

- General Primary (Runoff) Election - PDF

- 2004 Preferential Primary and Non-Partisan Judicial Election - PDF

2002 Election Results

- 2002 General - November 5, 2002 - PDF

- 2002 Preferential Primary & Non-Partisan Judicial May 21, 2002 - PDF

- 2002 Preferential Primary Run-off June 11, 2002 - PDF

2001 Election Results

- 2001 Special Primary US Congress District 3 September 25, 2001Summary Reports - PDF

- 3rd Congressional District Special Primary Election Official Results - Democratic Party - ZIP

- 3rd Congressional District Special Primary Election Official Results - Republican Party - ZIP

- 3rd Congressional District Special Primary Run-off Official Results - Democratic Party - ZIP

- 3rd Congressional District Special Primary Run-off Official Results - Republican Party - ZIP

- 3rd Congressional District Special General Election Official Results - ZIP

2000 Election Results

- Certified General Election Results - PDF

- Certificate of Certification of the Primary Election Results - PDF

- Summary of the Official Primary Election Results by County - XLS

- Official 2000 Primary Election Results by County and Precinct- XLS

- Certificate of Certification of the Primary Run Off Election Results- PDF

- Summary of the Official Primary Run Off Election Results by County- XLS

- Official 2000 Primary Run Off Election Results by County and Precinct - XLS

- House Districts 33 & 53 Special Election Results - Primary & General - XLS

- Senate District 31 & House District 89 Special Election Results - Primary, Runoff and General - XLS

- Download 2000 General Election Results by County - ZIP

- Download 2000 General Election Results by County & Polling Location - ZIP

- Download 2000 Special Election for District 12 Results by County and County & Polling Location - ZIP

- Download 2000 Special Election for District 27 Results by County and County & Polling Location - ZIP

1999 Election Results

- Primary Election Results- XLS

- House District 14 Special Election Results - Primary & General- XLS

- Election Results for 1999 Highway Bond Issue- XLS

1998 Election Results

- Download 1998 Primary Results by County - XLS (zipped)

- Download 1998 Primary Runoff Results by County - XLS (zipped)

- Download 1998 Primary Runoff Results - XLS (zipped)

- Official 1998 General Election Results by County & Precinct - XLS (zipped)

1996 Election Results

- Official 1996 Election Results - PDF

- Primary Election Results- XLS

- Primary Runoff Election Results- PDF

- Download 1996 Results by County- XLS

- Download 1996 Results by County & Precinct - XLS

1994 Election Results

1992 Election Results

1976-1990 Election Results

- 1976 Election Results-PDF

- 1978 Election Results-PDF

- 1980 Election Results-PDF

- 1982 Election Results-PDF

- 1984 Election Results-PDF

- 1986 Election Results-PDF

- 1988 Election Results-PDF

- 1990 Election Results-PDF

Click here, for more information about voter registration status, polling locations and sample ballots.

2026 Election Dates

- March 3rd, 2026- Preferential Primary & Nonpartisan General Election

- March 31, 2026-General Primary(Runoff)

- November 3rd, 2026- General Election & Nonpartisan Runoff Election

- December 1st, 2026- General Runoff Election

Register to Vote

- Voter Registration Application (English) - PDF

- Voter Registration Application (Spanish) - PDF

- Voter Registration Information

- Voter Registration FAQs

- Request an application through the mail (USPS) - Online Form

Absentee, Military, and Overseas Voting

Additional Information

- 2026 Candidate Search

- Voting in Arkansas

- Conducting a Voter Registration Drive

- Contact Your Elected Official

- Election Video Series

Check Your Voter Registration Information

Nonprofits / Charitable Entities

Nonprofit corporations are created for public benefit, for mutual benefit for its members, or for religious purposes. Nonprofit corporation status does not guarantee that the organization will be granted tax-exempt status, nor does it ensure that the contributions to the organization are tax deductible. Becoming a nonprofit corporation is generally a prerequisite to applying for tax-exempt status under the Internal Revenue Service (IRS) Code, such as section 501(c)(3). To accommodate the vast number of entities choosing to file for 501(c)(3) status with the IRS, the Arkansas Secretary of State provides a blank template with suggested IRS language as well as the traditional nonprofit articles of incorporation templates. If the nonprofit corporation intends to solicit charitable contributions, it must also register as a charitable entity with the Arkansas Secretary of State's office which can be done by going here: Charitable Entities

To access forms (including nonprofit annual reports) for both domestic and foreign nonprofits, click HERE

Below are some (but not all) important reminders about nonprofit entities:

- May not have shareholders or pay dividends.

- Are created by filing Articles of Incorporation with the Arkansas Secretary of State.

- Must file an annual disclosure statement with the Arkansas Secretary of State.

- May compensate members, officers, and trustees (in reasonable amounts) for services rendered.

- Must have specific provisions in its Articles of Incorporation dealing with property distribution upon dissolution.

The Business and Commercial (BCS) Services Division of the Secretary of State records and certifies Notaries Public for the State of Arkansas. A Notary Public verifies the identity of an individual who appears before them. The Notary acts as an official and unbiased witness to the identity of a person whether the person is taking an oath, giving oral or written testimony, or acknowledging his/her signature on a legal document.

To apply for (register) or renew a notary commission or to change (amend) your address you will create a new user account http://bcs.arkansas.gov. If you created an online user account prior to 1/25/2024 you will need to create a new one.

For instructions on using the system, refer to the Notary System User Guide. For step by step instructions on the application process and notary rules and procedures refer to the Notary Handbook (interim edition).

Pursuant to Act 215 of 2019, if you are a non-resident spouse of a United States military service member working in Arkansas, or operating a business in Arkansas, and wish to become an Arkansas Notary Public, please contact our office at 501-682-1010.

- Notary System User Guide (PDF)

- Notary Change of Information (PDF)

- Notary Affidavit & Acknowledgement Templates for Public Use (PDF)

- Notario Publico Disclaimer (PDF)

- Declaration of Domicile (PDF)

- Notary Complaint Form with Instructions (PDF)

- Online Notary Public Exam

For all questions regarding the Notary Public, please contact our office at 501-682-1010.

PLEASE USE CHROME BROWSER FOR THE TRAINING BELOW

Registration of Facsimile Signature of Public Officials

Arkansas law permits a public official to use a facsimile signature in lieu of his or her manual signature on any public security or any instrument of payment. The public official must first register his or her manual signature with the Arkansas Secretary of State's office, pursuant to Arkansas Code Annotated 21-10-102.

NOTICE:

Due to heavy volume, the anticipated filing times for all corporation / LLC filings are as follows:

1. All mailed in documents: 1-3 business days after received

2. All dropped off documents: 1-3 business days

3. All online filings: 1-3 business days.

To start a new business entity, follow the steps below:

1. Download the SOS "DOING BUSINESS IN ARKANSAS" booklet HERE

2. If you have any questions, visit our FREQUENTLY ASKED QUESTIONS page HERE

3. Search for your BUSINESS NAME AVAILABILITY HERE

4. New Business Filings:

To file YOUR NEW ENTITY ONLINE, click HERE

To file via PDF PAPER FORMS, click HERE

5. To apply for an EIN (Employment Identification Number) with the IRS, go to this website

AFTER you have filed and received your new entity from the Secretary of State

https://www.irs.gov/businesses/small-businesses-self-employed/how-to-apply-for-an-ein

Click HERE to file your FRANCHISE TAXES ONLINE

NOTICE:

Due to heavy volume, the anticipated filing times for all corporation / LLC filings are as follows:

1. All mailed in documents: 1-3 business days after received

2. All dropped off documents: 1-3 business days

3. All online filings: 1-3 business days

To enter the Corporations / LLC / Nonprofit Online Filing System click HERE To access all Paper Forms / Filing Fees for all entities click HERE To file Partnership only Annual Reports click HERE To do a Business Entity Search or seach for a filing number, click HERE

Click HERE for all RECORDS REQUESTS

Previous Meetings

REQUEST FOR QUALIFICATIONS

The Arkansas Secretary of State’s Office (SOS) is requesting qualifications from architecture firms for professional on-call architectural services related to various construction, restoration, renovation, and repair projects within the State Capitol building and upon its grounds in Little Rock, Arkansas. Qualified firms shall be properly licensed and insured and demonstrate verifiable experience in planning and design, new construction, building and infrastructure renovation, repairs, restoration, modifications, demolition, and alterations involving structural, mechanical, utility, and other systems. Firms with substantive knowledge and experience working with historic and historically-significant civic and governmental buildings and projects are preferred. Highly- qualified firms may have experience working on buildings on the National Register of Historic Places, preservation of such buildings’ historical attributes/original character, and experience with historically-relevant materials.

Responses shall be evaluated on the following criteria:

The firm’s unique abilities to meet the requirements of the request for qualifications (RFQ).

Experience and qualifications with projects in architecture, engineering, construction administration, and planning consistent with the scope of work identified in the RFQ.

Qualifications of the project manager and other key project team members.

References familiar with the quality of work of the firm.

Current project workload, state projects awarded, and recent experience with project costs and schedules.

Proximity to and familiarity with the Arkansas State Capitol building and grounds.

Other factors that may be appropriate to the scope of work identified in the RFQ.

The SOS Office will appoint a selection committee which will evaluate each response based upon the above criteria and may require firms to make on-site oral and visual presentations which will be further evaluated based upon the following criteria:

Overview of the Vendor.

Similar Projects Completed.

Experience.

SOS staff shall enter negotiations with the most responsive firm to negotiate fees and finalize a contract. If SOS staff is unable to negotiate a satisfactory fee structure for the services to be provided with the most responsive firm, negotiations will be formally terminated and negotiations with the next highest scoring firm will be initiated. The negotiation process will be repeated until a selection has been made, or until such time as the SOS Office decides not to move forward with a contract.

Firms may submit written questions requesting clarification of information contained within this RFQ. Please reference the RFQ number (RFQ # 2019-1) in the subject line. Written questions shall be addressed only to:

Jodi Bourne

Email: jodi.bourne@sos.arkansas.gov

The deadline for submitting questions specific to the RFQ shall be August 16, 2019; 4:00 pm CST.

Written questions shall be consolidated and responded to by SOS staff and posted to the SOS website.

One (1) original and three (3) hard copies of each response (each copy bound in a single volume where practical) and one (1) electronic redacted (pdf) copy on flash drive shall be submitted to:

Arkansas Secretary of State

Attn: Capitol Facilities Office, Jodi Bourne

500 Woodlane, Suite 31

Little Rock, AR 72201

All responses to this RFQ shall be received by the SOS Office no later than September 10, 2019; 4:00 pm CST.

For any additional information or to request an RFQ packet, please call 501-682-6244, or email Jodi.bourne@sos.arkansas.gov

Documents & Forms

National Statuary Hall Collection

The United States Congress authorized the creation of the National Statuary Hall Collection in 1864 to allow each state to provide two (2) statues of notable citizens for display in the United States Capitol. Arkansas has two (2) statues presently displayed in the National Statuary Hall Collection, one (1) dedicated to U.M. Rose by Senate Concurrent Resolution No. 6, Acts 1915, and one (1) dedicated to James P. Clarke by Acts 1917. Federal legislation enacted in 2000, provided that states may request the replacement of statues which have been displayed for at least 10 years by a resolution of the state legislature and approval of the Governor.

Act 1068 of 2019

Act 1068 of 2019, effective July 24, 2019, was enacted by the Arkansas General Assembly to authorize the replacement of the existing statues of U.M. Rose and James P. Clarke with statues of Daisy Lee Gatson Bates and John R. “Johnny” Cash. The act also established the National Statuary Hall Collection Trust Fund through which donations may be made to fund the replacement of both statues.

Submitting Donations

If you would like to donate money to the National Statuary Hall Collection Trust Fund, please complete the donor information below, make checks payable to Treasurer of the State of Arkansas and mail or deliver your check and this form to:

Arkansas Secretary of State’s Office

State Capitol, Suite 12

500 Woodlane Street

Little Rock, Arkansas 72201

Click Here to Download the Donation Form

Please address any questions to: Kurt Naumann, Director of Administration, 501-680-0239 or kurt.naumann@sos.arkansas.gov.

| Description | Form # | Paper $ | PDF Form |

| National UCC Charging Application | CA-1 | $16.00* | |

| National UCC Charging Application Amendment | CA-3 | $6.00* |

*Each additional page is $0.50 up to a maximum of $100.

**Termination fee paid at the time of filing.

Note: A court order must accompany all charging applications. Filings must be submitted via paper forms.

Arkansas Projected: Maps in the Arkansas State Archives

Arkansas's Western Post: Fort Smith's Two Centuries

Womens Suffrage: Their Rightful Place

Tiny Bricks, Big Dreams: Legos in December

War, Collections, Memory: The Great War in the Arkansas State Archives

When, in 1917, the United States entered the world war, Arkansans in all walks of life stepped forward. Over 70,000 Arkansans, black and white, served in uniform. By war’s end, nearly 4,000 had died or were seriously wounded.

Within months after the Armistice, the World War became the stuff of memories; the Arkansas History Commission (today’s Arkansas State Archives) partnered with Louis C. Gulley, an enthusiastic battlefield collector, to assemble a significant array of artifacts, memorabilia, documents and curiosa related to the war. This trove, augmented by government documents, personal papers and other artifacts, remains one of the Archives’s largest and richest collections.

For many years, items from the Gulley collection were displayed in the Arkansas Capitol as the “Museum of the World War.” This spring, the Great War returns to the Capitol: “War, Collections, Memory” features significant and memorable artifacts, photographs and documents from the State Archives related to “the war to end war.” The exhibit is not a comprehensive history of Arkansans in the war; instead, it samples the materials collected and preserved in order to preserve the stories of the conflict. These range from predictable battlefield trophies such as bayonets and helmets, to fragments of buildings damaged by shell fire and items sewed by Arkansas women for the American Red Cross. A bullet-riddled helmet, mess cup and iron body armor attest to the dangers of facing modern small-arms fire, while playing cards and a chess set improvised by German prisoners of war represent soldiers’ attempts to set aside the horrors of the field, if only for a little while. The home front is represented by a box of bandages rolled by Arkansas women for use in field hospitals overseas, and by identification photographs of resident German nationals who were required to register as enemy aliens in 1917.

Nearly a century has gone by since the cease-fire of November 11, 1918, but in the Arkansas State Archives and, through August, the halls of the Capitol, the echoes of that heartbreaking conflict remain.

“War, Collections, Memory: the Great War in the Arkansas State Archives” will remain on display in the first floor galleries of the Arkansas Capitol through August 2018.

Mixed Company: When Dolls Come Out To Mingle

Hoxie: Right in '55

From its founding in the 1880s until ten years after the end of World War II, the northeast Arkansas town of Hoxie was an agricultural town, a railroad town, a cotton market town. Its greatest assets were its location, at the junction of two railroads, the fertile farmland around it and its children, served by a school system that was a source of community pride.

In July 1955, however, Hoxie and its schools became objects of national attention. After the local school board moved to end racial segregation, acting on moral, legal and practical considerations, Hoxie became the object of attempts by outside forces to influence its path. “Remember Hoxie” became a rallying cry for proponents of states' rights and continued segregation: the incident spurred a surge of white activism and helped boom the political career of James D. “Justice Jim” Johnson. In the end, though, the Hoxie schools stayed the course and remained integrated. Over time, Hoxie’s notoriety faded, especially as the events of 1957 in Little Rock, which had been foreshadowed by the Hoxie controversy, unfolded.

“Hoxie: Right in ’55,” The Arkansas Capitol’s fall exhibit, recalls the saga of how this Arkansas town dealt with changing law and changing times, and what came of it. Vintage images and memorabilia of Hoxie and its schools, as well as documentary materials from the Arkansas State Archives, tell the stories of the town and the main actors in what one historian styled “the Hoxie imbroglio.” The exhibit ends by suggesting some consequences, including current efforts by Hoxie community members to preserve, interpret and help spread understanding of what happened in their town.

Today, more than six decades and more since Hoxie’s minutes of fame, community members of the Hoxie: The First Stand committee are working to create a museum that will preserve memories of the Hoxie desegregation and interpret the story for future generations. In 1955, the Hoxie school board, students, staff and, ultimately, the town, chose the right. That choice would create echoes far beyond the bounds of the Hoxie school district. In “Hoxie: Right in ’55,” we remember the events of 1955 and salute those who would preserve those memories as a legacy for the Hoxie of days to come.

Let’s Ride: Mountain Biking in the State Parks of Arkansas

Once upon a time, all bicycles were, really, “dirt bikes.” In cycling’s earliest days, wheelmen—and women--followed uneven gravel roads and rough paths, both to get from point “a” to point “b” and for the sheer joy of the ride. Today, many cyclists have rediscovered the fun and challenges of unpaved riding, and Arkansas’s state parks offer a variety of such opportunities. This summer, the Arkansas State Capitol’s first-floor galleries feature “Let’s Ride: Mountain Biking in the State Parks of Arkansas,” a celebration of adventurous cycling around the Natural State.

Created by the Arkansas Department of Parks and Tourism in collaboration with the Secretary of State’s office, “Let’s Ride” highlights the state parks’ connection to the beginnings of mountain biking in Arkansas: two staffers at Devil’s Den State Park helped organize the state’s first mountain bike gathering, the Ozark Mountain Bike Festival, at Devil’s Den in 1989. Today, state parks feature mountain bike trails for cyclists of all skill levels, ranging from beginner routes to rocky advanced-level “technical” trails. The Delta Heritage Trail, a state park venture, is a crushed limestone rail-to-trail path that when completed will offer a nearly eighty-five mile “gravel grinding” ride through the historic and scenic heart of the state’s southeastern quarter.

The exhibit includes scenes from trails statewide, as well as examples of the two-wheeled technology suited for them: one cycle, a 1980s-vintage GT “Karakoram,” is a veteran of the original 1989 Devil’s Den event. Others, loaned by area cycle shops and distributors, illustrate the variety of modern-day mountain cycles. A fourth is “all business”: a law enforcement-spec bike used by Arkansas park rangers.

To learn more about mountain biking opportunities in the state parks, visit: https://www.arkansasstateparks.com/biking/.

Accountable for Treasures

The Auditor of State is one of the seven constitutional officers of Arkansas’s state government. The post was created in the Constitution of 1836 and acts as the State’s general accountant, keeping track of fund and appropriation balances of all state agencies and writing warrants or checks in payment of the liabilities of the State, including paychecks of state employees. The Auditor also carries out other responsibilities; the best-known of these is managing the state’s Unclaimed Property program.

“Accountable for Treasures,” the Capitol’s autumn exhibit, affords visitors a rare look at a rich sample of items which have been “left behind.” Unclaimed property is any financial asset, held for a person or entity that cannot be found. It may consist of bank account balances, uncollected wages, securities, refunds or checks of many kinds, but safe deposit box contents are the most varied and most evocative. These lock boxes may contain money but often, more personal items are left behind, including personal papers, awards and decorations, collections with high intrinsic value (such as rare coins or stamps) and others with value mainly to the men or women whose obsessions they reflected.

“Accountable for Treasures” features an assortment of items removed from safe deposit boxes from across Arkansas and sent to the Auditor’s office in hope that owners or their heirs will claim them. Highlights include extensive coin collections, silver ingots, military medals, family photographs and letters, jewelry and souvenir trinkets. One collection consists exclusively of Beanie Babies plush toys, another encompasses watches, belt buckles, ID bracelets, books, numerous men’s rings and a bottle of vintage champagne while yet another combines Beatles LPs with VHS copies of films featuring Sean Connery as James Bond. A pair of police service revolvers, once the property of a Pine Bluff patrolman, are displayed near an accumulation of pocket knives both pristine and well-used and a silver trinket box containing a gold teddy-bear ring.

The exhibit also features a rare relic of the office’s history: a letter book preserving the official correspondence of State Auditors beginning in 1836 and continuing into the 1870s. The letter book is featured through the courtesy of the Arkansas State Archives, which acquired the book on Arkansas’s 180th birthday, June 15, 2016.

Finding Your Adventure

On August 25, 1916, President Woodrow Wilson signed into law a measure creating a new agency within the Department of the Interior, charged with managing an assortment of over thirty places already set aside by the federal government. That agency, the National Park Service, would grow both in size and in responsibilities carried. Today, as it approaches its 100th birthday, the National Park Service oversees more than four hundred sites encompassing more than 84 million acres spread across the United States, its trust territories and protectorates.

Finding Your Adventure, the Arkansas Capitol’s summer exhibit for 2016, is a birthday salute to the National Park System (NPS) and a “sampler” of its Arkansas sites. They are distinguished by their variety: in them, one may take a hike, sink into a thermal bath or float a river. One can stand where battles raged in the Civil War and in the Civil Rights Movement, explore an historic courthouse or a U.S. President’s childhood home and much more.

The exhibit features artifacts and images selected by staff members from each of the seven NPS sites within Arkansas. Architectural details and bath house memorabilia represent Hot Springs National Park, while Fort Smith National Historic Site’s offerings include a court document pertaining to notorious bank robber Henry Starr, signed by famed “hanging judge” Isaac Parker. Buffalo National River is represented by a half-canoe, crafted from a wrecked watercraft by park staff, while the William J. Clinton Birthplace and Home contributes a Little Golden Book once the property of a young Billy Blythe, the future president.

For 100 years the National Park Service has protected the nation’s natural and cultural treasures, preserved its stories and provided opportunities for recreation, learning, discovery and awe. These are your public lands and in this Centennial Anniversary year, the Capitol, along with the NPS, encourages visitors—natives and out-of-staters alike—to seek and find adventure in a national park in Arkansas.

Finding your Adventure will remain on display through Labor Day.

Ghost Signs of Arkansas

Beginning in the mid-Nineteenth century and continuing into the Twentieth, a new kind of graphic blossomed across America: outdoor advertising, in the form of signs painted on building walls or roofs or even natural features. Many of these advertised local concerns but also were “privilege” signs—ones promoting regional or even nationally-branded products such as Coca-Cola, patent medicines, tobacco products or cigars. Painted with care and stylistic flair by lettering artists who earned the appellation “wall dogs,” these signs boomed the products and enterprises of a growing, diversifying American economy.

Such signs once covered almost any flat building side. With the spread of billboards and other advertising media, the vogue for wall signs faded; many signs were obscured as new buildings went up, others were covered over with paint or plaster and many were simply left to fade away. The wall dogs did good work, though; across Arkansas and the nation, these graphics (many created using tenacious lead-based paint) survive as “ghost signs,” persistent reminders of our business past.

In the 1990s, the Arkansas Historic Preservation program, a division of the Department of Arkansas Heritage, began documenting Arkansas’s ghost signs. This project led to “Ghost Signs of Arkansas: Off-The-Wall Relics,” an exhibit which made its debut at the Old State House Museum in 1994. The exhibit featured photographs by Jeff Holder and text by Cynthia Haas, both of the Arkansas Historic Preservation Program. The images recorded fading wall signage from Trumann, Fordyce, Conway, Pine Bluff, Prescott and other towns across the state; many of the signs had outlasted the products they publicized. In 1997, the University of Arkansas Press issued Ghost Signs of Arkansas, in which Haas and Holder expanded on the exhibit. The exhibit itself graced the offices of the Arkansas Senate for many years, then went into storage.

This summer, however, Capitol visitors will be able to enjoy these “ghosts” once more; Ghost Signs of Arkansas is on view in the Capitol’s lower-level gallery through August. The images are more than two decades old and the survival rate of the signs depicted is unknown, so for this outing the exhibit is doubly “ghostly”: the signs recorded were shades of their original selves, and their images may virtually preserve the shades of things that have disappeared altogether.

Content

Thank You

Your request was successfully submitted.

A.C.A. § 26-54-101 et al., also known as the “Arkansas Corporate Franchise Tax Act of 1979”, requires all Corporations, LLC's, Banks, and Insurance Companies registered in Arkansas to pay an annual franchise tax. Failure to pay can result in the imposition of additional fees, penalties and interest, or even revocation of the authorization to do business. Franchise taxes continue to accrue, even for revoked businesses, until the business is dissolved, withdrawn, or merged. And, per A.C.A. § 26-54-114, any additional BCS filings are prohibited for persons or entities that fail to pay the franchise tax.

For fastest service, choose to file online by clicking the ONLINE link and proceed to file electronically which is payable by credit card ($5.00 processing fee). If the filing type is not available online or if you prefer to mail or deliver your filing (no processing fee), click “PDF” to print a copy, complete the form, attach payment and mail or deliver to the Business and Commercial Services office.

Click HERE to file your FRANCHISE TAXES ONLINE

To do a BUSINESS ENTITY NAME SEARCH or seach for a FILING NUMBER, click HERE.

| Name of Official Document | Form# | Online Fee | Paper Fee | Online | PDF 2025 | PDF 2024 | PDF 2023 | PDF 2022 |

| Corporations with Stock | N/A | Min. $150 | Min. $150 | ONLINE | ||||

| Corporations without Stock | N/A | $300 | $300 | ONLINE | ||||

| Banks | N/A | Min. $150 | Min. $150 | ONLINE | ||||

| Limited Liability Company LLC or PLLC | N/A | $150 | $150 | ONLINE | ||||

| Insurance Corporation Legal Reserve Mutual, Assets Less Than $100 million | N/A | $300 | $300 | ONLINE | ||||

| Insurance Corporation Legal Reserve Mutual, Assets Greater Than $100 million | N/A | $400 | $400 | ONLINE | ||||

| Insurance Company Outstanding Capital Stock Less Than $500,000 | N/A | $300 | $300 | ONLINE | ||||

| Insurance Company Outstanding Capital Stock Greater Than $500,000 | N/A | $400 | $400 | ONLINE |

Forms / Fees / Records Requests

Choose to file online by clicking the ONLINE link and proceed to file electronically which is payable by credit card. If the filing type is not available online or if you prefer to mail or deliver your filing, click “PDF” to print a copy, complete the form, attach payment and mail or deliver to the Business and Commercial Services office.

For all RECORDS REQUESTS, click here for instructions and request form

General Partnership

Domestic Partnerships | Foreign Partnerships | General Partnerships

| Name of Official Document | Form # | Online Fee | Paper Fee | Online Form | PDF Form |

| Notice of Change of Registered Agent for General Partnership | DO-03 | No Fee | No Fee | ONLINE | |

| Notice of Change of Principal Office Address for General Partnership | No Fee | No Fee | N/A | ||

| Notice of Change of Foreign Address for Foreign General Partnership | No Fee | No Fee | N/A | ||

| Application for Articles of Organization for Conversion from Partnership or Limited Partnership to Limited Liability Company | N/A | $15.00 | N/A | ||

| Application for Conversion from LP to GP | N/A | $15.00 | N/A | ||

| Statement of Partnership Authority | N/A | $50.00 | N/A | ||

| Statement of Foreign Partnership Authority | N/A | $300.00 | N/A | ||

| Statement of Merger | N/A | $15.00 | N/A | ||

| Statement of Dissociation | N/A | $15.00 | N/A | ||

| Statement of Denial | N/A | $15.00 | N/A | ||

| Statement of Dissolution | N/A | $15.00 | N/A |

Forms / Fees / Records Requests

Choose to file online by clicking the ONLINE link and proceed to file electronically which is payable by credit card. If the filing type is not available online or if you prefer to mail or deliver your filing, click “PDF” to print a copy, complete the form, attach payment and mail or deliver to the Business and Commercial Services office.

For all RECORDS REQUESTS, click here for instructions and request form

Foreign Partnerships

Domestic Partnerships | Foreign Partnerships | General Partnerships

Foreign Limited Partnership

| Name of Official Document | Form # | Online Fee | Paper Fee | Online Form | PDF Form |

| Annual Report for Limited Partnership 2014 and before | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2015 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2016 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2017 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2018 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2019 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2020 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2021 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2022 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2023 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2024 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2025 | LP-AR | No Fee | No Fee | ONLINE | |

| Application for Fictitious Name Foreign Limited Partnership |

F-18 | N/A | $15.00 | N/A | |

| Cancellation of Fictitious Name Foreign Limited Partnership | CFN | N/A | $15.00 | N/A | |

| Transfer of Fictitious Name for Foreign Limited Partnership | TFN | N/A | $25.00 | N/A | |

| Notice of Change of Registered Agent for LP | No Fee | No Fee | N/A | ||

| Notice of Change of Principal Office Address for LP | No Fee | No Fee | N/A | ||

| Notice of Change of Foreign Address for LP | No Fee | No Fee | N/A | ||

| Application for Certificate of Authority of Foreign Limited Partnership | LPF-01 | N/A | $300.00 | N/A | |

| Application for Articles of Organization for Conversion from a Partnership or Limited Partnership to Limited Liability Company | N/A | $15.00 | N/A | ||

| Application for Conversion from LP to GP |

N/A | $15.00 | N/A | ||

| Application for Contact Change of Address |

No Fee | N/A | ONLINE | N/A | |

| Foreign Partnership Cancellation | N/A | No Fee | N/A | ||

| Statement of Termination for LP and LLLP | N/A | No Fee | N/A |

Foreign Limited Liability Partnership

| Name of Official Document | Form # | Online Fee | Paper Fee | Online Form | PDF Form | |

| Application for Fictitious Name Foreign Limited Liability Partnership |

F-18 | N/A | $15.00 | N/A | ||

| Cancellation of Fictitious Name Foreign Limited Liability Partnership | CFN | N/A | $15.00 | N/A | ||

| Transfer of Fictitious Name Foreign Limited Liability Partnership | TFN | N/A | $25.00 | N/A | ||

| Notice of Change of Registered Agent for LLP | DO-03 | No Fee | No Fee | ONLINE | ||

| Notice of Change of Principal Office Address for LLP | No Fee | No Fee | N/A | |||

| Notice of Change of Foreign Address for LLP | No Fee | No Fee | N/A | |||

| Statement of Qualification of Foreign LLP (old code) |

N/A | $300.00 | N/A | |||

| Statement of Qualification of Foreign LLP (new code) |

N/A | $300.00 | N/A | |||

| Amendment of Foreign Limited Liability Partnership | N/A | $15.00 | N/A | |||

| Annual Report - Limited Liability Partnership 2014 and before | $15.00 | $15.00 | ONLINE | |||

| Annual Report - Limited Liability Partnership 2015 | $15.00 | $15.00 | ONLINE | |||

| Annual Report - Limited Liability Partnership 2016 | $15.00 | $15.00 | ONLINE | |||

| Annual Report - Limited Liability Partnership 2017 | $15.00 | $15.00 | ONLINE | |||

| Annual Report - Limited Liability Partnership 2018 | $15.00 | $15.00 | ONLINE | |||

| Annual Report - Limited Liability Partnership 2019 | $15.00 | $15.00 | ONLINE | |||

| Annual Report - Limited Liability Partnership 2020 | $15.00 | $15.00 | ONLINE | |||

| Annual Report - Limited Liability Partnership 2021 | $15.00 | $15.00 | ONLINE | |||

| Annual Report - Limited Liability Partnership 2022 | $15.00 | $15.00 | ONLINE | |||

| Annual Report - Limited Liability Partnership 2023 | $15.00 | $15.00 | ONLINE | |||

| Annual Report - Limited Liability Partnership 2024 | $15.00 | $15.00 | ONLINE | |||

| Annual Report - Limited Liability Partnership 2025 | $15.00 | $15.00 | ONLINE | |||

| Application for Contact Change of Address |

No Fee | N/A | ONLINE | N/A | ||

| Foreign Partnership Cancellation | N/A | No Fee | N/A | |||

| Statement of Termination for LLP | N/A | No Fee | N/A |

Foreign Limited Liability Limited Partnership

| Name of Official Document | Form # | Online Fee | Paper Fee | Online Form | PDF Form |

|

Application for Certificate of Authority of Foreign Limited Liability Limited Partnership

|

F3LP-02 | N/A | $300.00 | N/A | |

| Annual Report for Limited Liability Limited Partnership 2014 and before | LLLP-AR | $15.00 | $15.00 | ONLINE | |

| Annual Report for Limited Liability Limited Partnership 2015 | LLLP-AR | $15.00 | $15.00 | ONLINE | |

| Annual Report for Limited Liability Limited Partnership 2016 | LLLP-AR | $15.00 | $15.00 | ONLINE | |

| Annual Report for Limited Liability Limited Partnership 2017 | LLLP-AR | $15.00 | $15.00 | ONLINE | |

| Annual Report for Limited Liability Limited Partnership 2018 | LLLP-AR | $15.00 | $15.00 | ONLINE | |

| Annual Report for Limited Liability Limited Partnership 2019 | LLLP-AR | $15.00 | $15.00 | ONLINE | |

| Annual Report for Limited Liability Limited Partnership 2020 | LLLP-AR | $15.00 | $15.00 | ONLINE | |

| Annual Report for Limited Liability Limited Partnership 2021 | LLLP-AR | $15.00 | $15.00 | ONLINE | |

| Annual Report for Limited Liability Limited Partnership 2022 | LLLP-AR | $15.00 | $15.00 | ONLINE | |

| Annual Report for Limited Liability Limited Partnership 2023 | LLLP-AR | $15.00 | $15.00 | ONLINE | |

| Annual Report for Limited Liability Limited Partnership 2024 | LLLP-AR | $15.00 | $15.00 | ONLINE | |

| Annual Report for Limited Liability Limited Partnership 2025 | LLLP-AR | $15/00 | $15.00 | ONLINE | |

| Notice of Change of Registered Agent for LLLP | DO-03 | No Fee | No Fee | ONLINE | |

| Notice of Change of Principal Office Address for LLLP | No Fee | No Fee | N/A | ||

| Notice of Change of Foreign Address for LLLP | No Fee | No Fee | N/A | ||

| Application for Fictitious Name | F-18 | N/A | $15.00 | N/A | |

| Cancellation of Fictitious Name | CFN | N/A | $15.00 | N/A | |

| Transfer of Fictitious Name | TFN | N/A | $25.00 | N/A | |

| Application for Contact Change of Address |

No Fee | N/A | ONLINE | N/A | |

| Foreign Partnership Cancellation | N/A | No Fee | N/A | ||

| Statement of Termination for LP and LLLP | N/A | No Fee | N/A |

Forms / Fees / Records Requests

Choose to file online by clicking the ONLINE link and proceed to file electronically which is payable by credit card. If the filing type is not available online or if you prefer to mail or deliver your filing, click “PDF” to print a copy, complete the form, attach payment and mail or deliver to the Business and Commercial Services office.

Series LLC forms can be found under the Miscellaneous Forms link.

Click HERE to file your FRANCHISE TAXES ONLINE

To do a BUSINESS ENTITY NAME SEARCH or seach for a FILING NUMBER, click HERE

Foreign LLC

Foreign Limited Liability Company

| Name of Official Document | Form # | Online $ | Paper $ | Online Form |

PDF Form |

| Application for Certificate of Registration of Foreign Limited Liability Company | FL-01 | $270.00 | $300.00 | ONLINE | |

| Board Resolution Adopting a Fictitious Name In Arkansas | N/A | No Fee | N/A | ||

| Application for Amended Certificate of Authority by Foreign Limited Liability Co. | FL-02 | $270.00 | $300.00 | ONLINE | |

| Application for Reservation of Limited Liability Company Name | RN-06 | $22.50 | $25.00 | ONLINE | |

| Notice of Transfer of Reserved Name for LLC | TRN-06 | $22.50 | $25.00 | ONLINE | |

| Application for Fictitious Name Foreign Limited Liability Co. |

F-18 | $22.50 | $25.00 | ONLINE | |

| Cancellation of Fictitious Name Foreign Limited Liability Co. | CFN | N/A | $25.00 | N/A | |

| Transfer/Cancellation of Fictitious Name Foreign Limited Liability Co. | CTN | N/A | $25.00 | N/A | |

| Application for Cancellation by FLLC | FL-04 | $45.00 | $50.00 | ONLINE | |

| Final Franchise Tax Report (Must be submitted with the Certificate of Cancellation by FLLC) | $150.00 | $150.00 | ONLINE | ||

| Franchise Tax Registration (use with FL-01) | N/A | No Fee | N/A | ||

| Corporation Service Companies | No Fee | No Fee | N/A | ||

| LLC Certificate of Transfer of Domicile (Domestication) to Arkansas | N/A | $300.00 | N/A | ||

| Application for Tax Contact Change of Address |

No Fee | N/A | ONLINE | N/A | |

| 2024 LLC Amended Franchise Tax Report | N/A | No Fee | N/A | ||

| 2025 LLC Amended Franchise Tax Report | N/A | No Fee | N/A | ||

| Notice of Change of Registered Agent | DO-03 | No Fee | No Fee | ONLINE | |

| Notice of Change of Principal Office Address for Foreign LLC | No Fee | No Fee | N/A | ||

| Notice of Change of Foreign Address for Foreign LLC | No Fee | No Fee | N/A |

Forms / Fees / Records Requests

Choose to file online by clicking the ONLINE link and proceed to file electronically which is payable by credit card. If the filing type is not available online or if you prefer to mail or deliver your filing, click “PDF” to print a copy, complete the form, attach payment and mail or deliver to the Business and Commercial Services office.

Click HERE to file your FRANCHISE TAXES ONLINE

To do a BUSINESS ENTITY NAME SEARCH or seach for a FILING NUMBER, click HERE

Foreign Corporations

Domestic Corporations | Foreign Corporations

Foreign Business Trust

| Name of Official Document | Form # | Online Fee | Paper Fee | Online Form | PDF Form |

| Application for Cert. of Registration of Foreign Business Trust |

FBT-01 | N/A | $300.00 | N/A | |

| Certificate of Amendment to Foreign Business Trust |

FBT-02 | N/A | $300.00 | N/A | |

| Application for Contact Change of Address | No Fee | N/A | ONLINE |

Foreign Corporation

| Name of Official Document | Form # | Online Fee | Paper Fee | Online Form | PDF Form |

| Application for Certificate of Authority | F-01 | $270.00 | $300.00 | ONLINE | |

| Board Resolution for Adoption of Fictitious Name | N/A | No Fee | N/A | ||

| Application for Amended Certificate of Authority | F-01A | $270.00 | $300.00 | ONLINE | |

| Notice of Transfer of Reserved Name | TRN-06 | $22.50 | $25.00 | ONLINE | |

| Application for Registration of a Corporate Name | F-05 | $45.00 | $50.00 Renewal $25.00 |

ONLINE | |

| Application for Fictitious Name of Foreign Corporation (new code) |

F-18 | $22.50 | $25.00 | ONLINE | |

| Cancellation of Fictitious Name Foreign Corporation | CFN | N/A | $25.00 | N/A | |

| Transfer/Cancellation of Fictious Name for Foreign Corporation | CTN | N/A | $25.00 | N/A | |

| Application for Reservation of a Corporate Name | RN-06 | $22.50 | $25.00 | ONLINE | |

| Notice of Change of Registered Agent | DO-03 | No Fee | No Fee | ONLINE | |

| Notice of Change of Principal Office Address | No Fee | No Fee | N/A | ||

| Notice of Change of Foreign Address | No Fee | No Fee | N/A | ||

| Corporation Service Companies | N/A | No Fee | N/A | ||

| Foreign Corporation Transacting Business in Arkansas | N/A | No Fee | N/A | ||

| Articles of Correction | F-15 | N/A | $30.00 | N/A | |

| Certificate of Withdrawal of Foreign Corporation |

F-13 | N/A | $300.00 | ONLINE | |

| Final Franchise Tax Report (Must be submitted with the Certificate of Withdrawal) | Minimum $150.00 | Minimum $150.00 | ONLINE | ||

| Franchise Tax Registration (use with F-01) |

N/A | No Fee | N/A | ||

| Application for Transfer of Jurisdiction to Arkansas | N/A | $300.00 | N/A | ||

| Application for Contact Change of Address |

No Fee | N/A | ONLINE | ||

| 2025 Amended Corporation Franchise Tax Report | N/A | No Fee | N/A | ||

| 2025 Amended Non-Stock Corporation Franchise Tax Report | N/A | No Fee | N/A | ||

| Notice of Change of Principal Office Address | No Fee | No Fee | N/A | ||

| Notice of Change of Foreign Contact Address | No Fee | No Fee | N/A | ||

| Notice of Change of Registered Agent | DO-03 | No Fee | No Fee | ONLINE | |

Foreign Benefit Corporation

| Name of Official Document | Form # | Online Fee | Paper Fee | Online Form | PDF Form |

| Application for Certificate of Authority for a Foreign Benefit Corporation | N/A | $300.00 | N/A | ||

| Application for Amended Certificate of Authority to Add Benefit Designation | N/A | $300.00 | N/A | ||

| Certificate of Amendment to Terminate Benefit Designation | N/A | $50.00 | N/A | ||

| Articles of Dissolution for a Benefit Corporation | N/A | $50.00 | N/A |

Forms / Fees / Records Requests

Choose to file online by clicking the ONLINE link and proceed to file electronically which is payable by credit card. If the filing type is not available online or if you prefer to mail or deliver your filing, click “PDF” to print a copy, complete the form, attach payment and mail or deliver to the Business and Commercial Services office.

For all RECORDS REQUESTS, click here for instructions and request form

Miscellaneous Forms

| Name of Official Document | Form # | Online Fee | Paper Fee | Online Form | PDF Form |

| Health Spa Consumer Protection Act | CDF-03 | N/A | N/A | N/A | |

| Appointment of Agent for Service of Process by Foreign Bank or Trust Company | CDF-04 | N/A | N/A | N/A | |

| Appointment of Agent for Non Qualified Entity | N/A | N/A | N/A | ||

| Application for Electronic Signature Verification Company | N/A | N/A | N/A | ||

| Application to Register/Renew as a Video Service Provider | N/A | $1,500.00 | N/A | ||

| Modification of Boundaries of Video Service Provider | N/A | $100.00 | N/A | ||

| Termination of Certificate of Franchise Authority for Video Service Provider | N/A | $100.00 | N/A | ||

| Application to Transfer Certificate of Franchise Authority for Video Service Provider | N/A | $100.00 | N/A | ||

| Publicity Rights Protection Registration Form | N/A | $25.00 | N/A | ||

| Domestic Protected Series Instructions | N/A | No Fee | N/A | ||

| Domestic Protected Series Application | N/A | $50.00 | N/A | ||

| Certificate of Amendment to Certificate of Organization for a Dom. Protected Series | N/A | $25.00 | N/A | ||

| Domestic Protected Series Dissolution | N/A | $50.00 | N/A | ||

| Domestic Series LLC Instructions | N/A | No Fee | N/A | ||

| Domestic Series LLC Application | N/A | $50.00 | N/A | ||

| Certificate of Amendment to Certificate of Organization for a Dom. Series LLC | N/A | $25.00 | N/A | ||

| Domestic Series LLC Dissolution | N/A | $50.00 | N/A | ||

| Foreign Protected Series Instructions | N/A | No Fee | N/A | ||

| Foreign Protected Series Application | N/A | $300.00 | N/A | ||

| Certificate of Amendment to Certificate of Organization for a Foreign Protected Series | N/A | $300.00 | N/A | ||

| Foreign Protected Series Cancellation | N/A | $50.00 | N/A | ||

| Foreign Series LLC Instructions | N/A | No Fee | N/A | ||

| Foreign Series LLC Application | N/A | $300.00 | N/A | ||

| Certificate of Amendment to Certificate of Organization for a Foreign Series LLC | N/A | $300.00 | N/A | ||

| Foreign Series LLC Cancellation | N/A | $50.00 | N/A | ||

| Change of Registered Agent for a Series LLC or Protected Series | N/A | No Fee | N/A | ||

| Change of Principal Office Address for a Series LLC or Protected Series | N/A | No Fee | N/A | ||

| Change of Foreign Address for a Foreign Series LLC or Foreign Protected Series | N/A | Ne Fee | N/A | ||

| Entrepreneur Fee Waiver Pilot Program Instructions and Application | N/A | No Fee | N/A |

Forms / Fees / Records Requests

Choose to file online by clicking the ONLINE link and proceed to file electronically which is payable by credit card. If the filing type is not available online or if you prefer to mail or deliver your filing, click “PDF” to print a copy, complete the form, attach payment and mail or deliver to the Business and Commercial Services office.

Public Water Authority

Public Water Authority

| Name of Official Document | Form # | Online Fee | Paper Fee | Online Form | PDF Form |

| Application for Reservation of Public Water Authority Name | N/A | $5.00 | N/A |

Forms / Fees / Records Requests

Choose to file online by clicking the ONLINE link and proceed to file electronically which is payable by credit card. If the filing type is not available online or if you prefer to mail or deliver your filing, click “PDF” to print a copy, complete the form, attach payment and mail or deliver to the Business and Commercial Services office.

Cooperative

| Name of Official Document | Form # | Online Fee | Paper Fee | Online Form | PDF Form |

| Application for Foreign Cooperative Seeking Authorization to Do Business in Arkansas | N/A |

AG, Mkt, Gen- $5.00 Tel, Elec- $10.00 |

N/A | ||

| Articles of Dissolution of Telecommunication Cooperative | N/A | $1.00 | N/A | ||

| Articles of Incorporation of Cooperative Marketing Association | N/A | $5.00 | N/A | ||

| Articles of Incorporation of Electric Cooperative Corporation | N/A | $10.00 | N/A | ||

| Articles of Incorporation of Telephone Cooperative | N/A | $10.00 | N/A | ||

| Certificate of Amendment of Cooperative Marketing Association | N/A | $2.50 | N/A | ||

| Certificate of Amendment of Electric Cooperative Corporation | N/A | $10.00 | N/A | ||

| Cooperative Marketing Association Annual Report 2025 | N/A | Varies | N/A | ||

| Cooperative Marketing Association Annual Report 2024 | N/A | Varies | N/A | ||

| Cooperative Marketing Association Annual Report 2023 | N/A | Varies | N/A | ||

| Cooperative Marketing Association Annual Report 2022 | N/A | Varies | N/A | ||

| Cooperative Marketing Association Annual Report 2021 | N/A | Varies | N/A | ||

| Cooperative Marketing Association Annual Report 2020 | N/A | Varies | N/A | ||

| Cooperative Marketing Association Annual Report 2019 | N/A | Varies | N/A | ||

| Cooperative Marketing Association Annual Report 2018 | N/A | Varies | N/A | ||

| Cooperative Marketing Association Annual Report 2017 | N/A | Varies | N/A | ||

| Cooperative Marketing Association Annual Report 2016 | N/A | Varies | N/A | ||

| Cooperative Associations Annual Report 2025 | N/A | Varies | N/A | ||

| Cooperative Associations Annual Report 2024 | N/A | Varies | N/A | ||

| Cooperative Associations Annual Report 2023 | N/A | Varies | N/A | ||

| Cooperative Associations Annual Report 2022 | N/A | Varies | N/A | ||

| Cooperative Associations Annual Report 2021 | N/A | Varies | N/A | ||

| Cooperative Associations Annual Report 2020 | N/A | Varies | N/A | ||

| Cooperative Associations Annual Report 2019 | N/A | Varies | N/A | ||

| Cooperative Associations Annual Report 2018 | N/A | Varies | N/A | ||

| Cooperative Associations Annual Report 2017 | N/A | Varies | N/A | ||

| Cooperative Associations Annual Report 2016 | N/A | Varies | N/A | ||

| Cooperative Association - Corp Annual Report 2025 | N/A | Varies | N/A | ||

| Cooperative Association - Corp Annual Report 2024 | N/A | Varies | N/A | ||

| Cooperative Association - Corp Annual Report 2023 | N/A | Varies | N/A | ||

| Cooperative Association - Corp Annual Report 2022 | N/A | Varies | N/A | ||

| Cooperative Association - Corp Annual Report 2021 | N/A | Varies | N/A | ||

| Cooperative Association - Corp Annual Report 2020 | N/A | Varies | N/A | ||

| Cooperative Association - Corp Annual Report 2019 | N/A | Varies | N/A | ||

| Cooperative Association - Corp Annual Report 2018 | N/A | Varies | N/A | ||

| Cooperative Association - Corp Annual Report 2017 | N/A | Varies | N/A | ||

| Cooperative Association - Corp Annual Report 2016 | N/A | Varies | N/A | ||

| Cooperative Annual Report (2015 and before) | CRD-01 | N/A | Varies | N/A | |

| Application for Contact Change of Address | No Fee | N/A | ONLINE | N/A |

Forms / Fees / Records Requests

Choose to file online by clicking the ONLINE link and proceed to file electronically which is payable by credit card. If the filing type is not available online or if you prefer to mail or deliver your filing, click “PDF” to print a copy, complete the form, attach payment and mail or deliver to the Business and Commercial Services office.

Commercial Registered Agent Filings

| The following filings are a result of the passage of the Model Registered Agents Act of 2007 (MoRAA Act). | |||||

| Name of Official Document | Form # | Online Fee | Paper Fee | Online Form | PDF Form |

| Commercial Registered Agent Registration | CRA-R | N/A | $50.00 | N/A | |

| Notice of Change of Commercial Registered Agent Information | CRA-CF | N/A | No Fee | N/A | |

| Commercial Registered Agent Termination Statement | CRA-TS | N/A | $50.00 | N/A | |

| Nonfiling / Nonqualified Entity Statement | NFR-R | N/A | No Fee | N/A |

Forms / Fees / Records Requests

Choose to file online by clicking the ONLINE link and proceed to file electronically which is payable by credit card. If the filing type is not available online or if you prefer to mail or deliver your filing, click “PDF” to print a copy, complete the form, attach payment and mail or deliver to the Business and Commercial Services office.

Domestic Partnerships

Domestic Partnerships | Foreign Partnerships | General Partnerships

Domestic Limited Partnership

| Name of Official Document | Form # | Online Fee | Paper Fee | Online Form | PDF Form |

| Annual Report for Limited Partnership 2014 and before | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2015 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2016 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2017 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2018 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2019 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2020 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2021 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2022 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2023 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2024 | LP-AR | No Fee | No Fee | ONLINE | |

| Annual Report for Limited Partnership 2025 | LP-AR | No Fee | No Fee | ONLINE | |

| Certificate of Limited Partnership | LP-01 | N/A | $50.00 | N/A | |

| Application for Fictitious Name Domestic Limited Partnership | DN-18 | N/A | $15.00 | N/A | |

| Cancellation of Fictitious Name Domestic Limited Partnership | CFN | N/A | $15.00 | N/A | |

| Transfer of Fictitious Name for Domestic Limited Partnership | TFN | N/A | $25.00 | N/A | |

| Notice of Change of Registered Agent for LP | DO-03 | No Fee | No Fee | ONLINE | |

| Notice of Change of Principal Office Address for LP | No Fee | No Fee | N/A | ||

| Application for Articles of Organization for Conversion from a Partnership or Limited Partnership to Limited Liability Company | N/A | $15.00 | N/A | ||

| Application for Conversion from LP to GP | N/A | $15.00 | N/A | ||

| Application for Contact Change of Address | No Fee | N/A | ONLINE | N/A | |

| Statement of Termination for LP and LLLP | N/A | $15.00 | N/A |

Domestic Limited Liability Partnership

| Name of Official Document | Form # | Online Fee | Paper Fee | Online Form | PDF Form |

| Application for Fictitious Name Dom. Limited Liab. Partnership | DN-18 | N/A | $15.00 | N/A | |

| Cancellation of Fictitious Name Dom. Limited Liab. Partnership | CFN | N/A | $15.00 | N/A | |

| Transfer of Fictitious Name for Dom. Limited Liab. Partnership | TFN | N/A | $25.00 | N/A | |

| Notice of Change of Registered Agent for LLP | DO-03 | No Fee | No Fee | ONLINE | |

| Notice of Change of Principal Office Address for LLP | No Fee | No Fee | N/A | ||

| Application for Registration of LLP (old code) | N/A | $50.00 | N/A | ||

| Statement of Qualification of LLP (new code) | N/A | $50.00 | N/A | ||

| Annual Report - Limited Liability Partnership 2014 and before | $15.00 | $15.00 | ONLINE | ||

| Annual Report - Limited Liability Partnership 2015 | $15.00 | $15.00 | ONLINE | ||

| Annual Report - Limited Liability Partnership 2016 | $15.00 | $15.00 | ONLINE | ||

| Annual Report - Limited Liability Partnership 2017 | $15.00 | $15.00 | ONLINE | ||

| Annual Report - Limited Liability Partnership 2018 | $15.00 | $15.00 | ONLINE | ||

| Annual Report - Limited Liability Partnership 2019 | $15.00 | $15.00 | ONLINE | ||

| Annual Report - Limited Liability Partnership 2020 | $15.00 | $15.00 | ONLINE | ||

| Annual Report - Limited Liability Partnership 2021 | $15.00 | $15.00 | ONLINE | ||

| Annual Report - Limited Liability Partnership 2022 | $15.00 | $15.00 | ONLINE | ||

| Annual Report - Limited Liability Partnership 2023 | $15.00 | $15.00 | ONLINE | ||